3335

3335

We found errors in our Fee Items. What do we do?

The answer will be based on the use of that fee item and whether there are open invoices attached to it.

Run the Transactions by Contact report to see if there are open invoices related to that fee item.

- If there are no open invoices: Deactivate fee item. Create new fee item.

- If open invoices: Mark the old fee item as "OLD" or "DO NOT USE" and perhaps add a date if you choose. Create a new one.

- QuickBooks Online Integration/ Best Practice Mode

- Follow above steps.

- Mark the old fee item as "OLD" or "DO NOT USE" and perhaps add a date if you choose.

- Create a new one.

- Map it to QB.

Wrong Chart of Accounts being used for a Fee Item

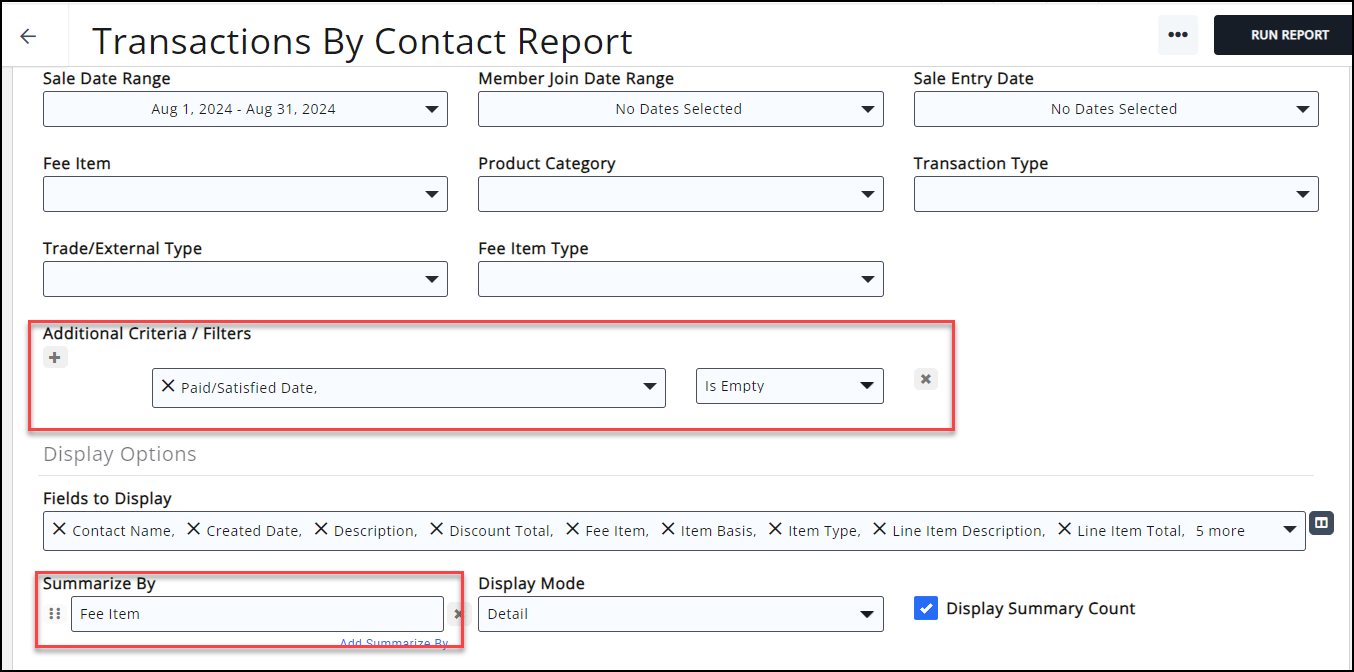

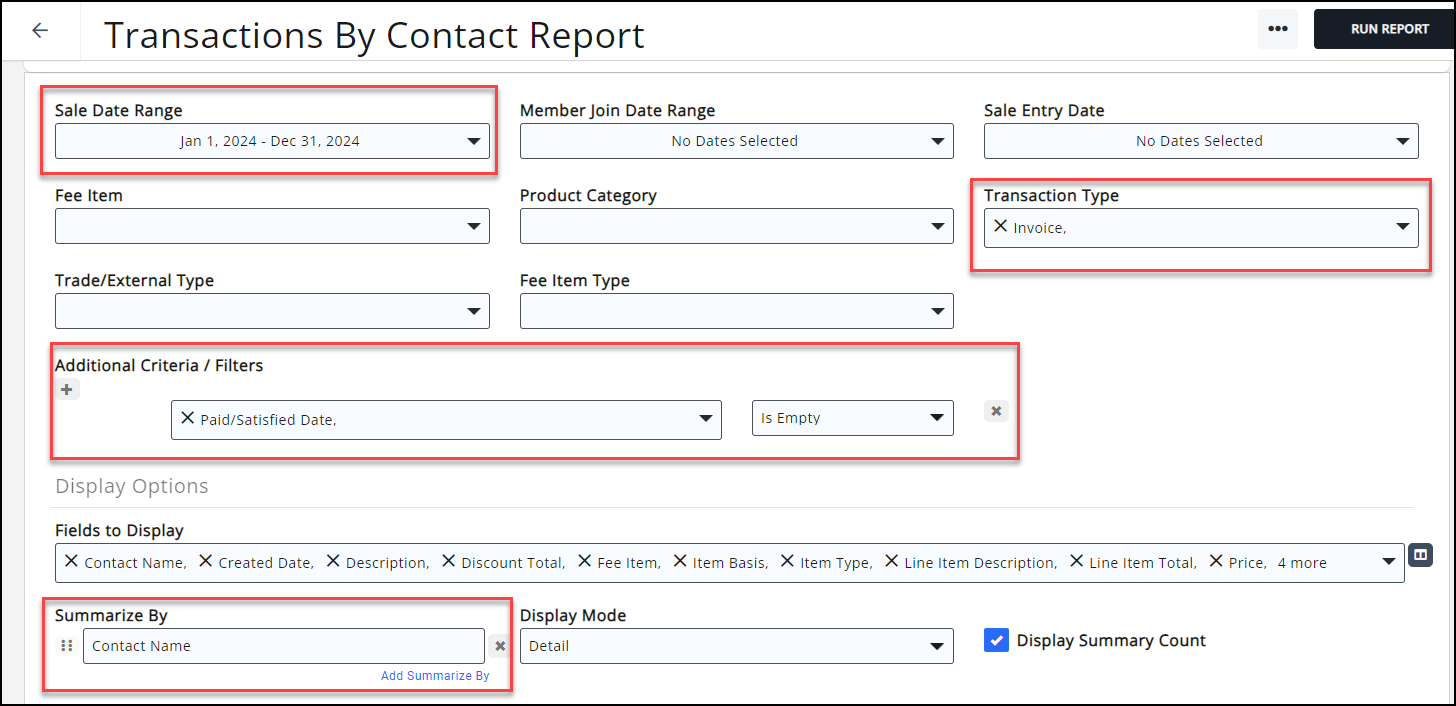

Adjustments to the fee item will depend on whether the fee item is tied to an invoice, but any entries made into the wrong account will not be changed. Run the Transactions by Contact report with filters to see if there is an open invoice attached to a fee item. Filter to a Sales Date Range. Choose Transaction Type of Invoice. Add Additional Criteria of Paid/Satisfied Is Empty. You can Summarize by Contact Name for easy reference or choose to also Summarize by Fee Item.

No open invoices

A) If no invoice is being used

- Deactivate the incorrect fee item.

- Create a new fee item and associate it to the proper account.

B) If using QuickBooks Online integration but no open invoices exist:

- Create a new fee item.

- Map it to QB.

- Put it in correct database locations (e.g. Event)

Open invoices attached to fee item

A) If open invoices are attached, the fee item cannot be deactivated until the invoices are closed.

- Edit Fee Item name with Do Not Use or possibly include a date to stop its usage.

- Create new fee item.

B) If using QuickBooks Online integration with open invoices attached to fee item:

- Edit name with Do Not Use or possibly include a date to stop its usage.

- Create a new fee item.

- Map it to QB.

- Put it in correct database locations (e.g. Event)

- Can do reporting on fee item to know when it was used an how much money affected the account. In your accounting software, follow your procedures, but you could use the total to make adjusted entries and record journal notations.

Wrong Chart of Account being used for Multiple Fee Items

- Follow the same process as indicated under Wrong Chart of Accounts being used for a Fee Item.

- Journal in accounting software per your accounting processes.

QuickBooks Online Integration Fee Item Questions

We don't want to use the revenue recognition of Fully on Invoice Date and want to defer instead. What happens?

GrowthZone recommends Fully on Invoice Date if you are using the QuickBooks Online Integration. If you choose to defer then that would be handled on the QuickBooks side.

I've created a new fee item. Now what?

Be sure to map the fee item under Setup > Integration > QuickBooks Online > Mappings

The fee item can now be used. If this fee item is meant to replace an incorrect fee item, be sure to double-check that the old fee item is not tied to any open invoices (see Open Invoices above) before you deactivate it.